Metro Vancouver July Stats Report

My crazy viral video, a little about my ties to Howe Sound, and a little about The Howe Sound Declaration / stopping Woodfibre LNG!

Cambie Corridor is exploding with new condo developments. Two major areas of development are Queen Elizabeth Park and 57th Avenue. This post explores these areas.

The 5 coolest properties I viewed in 2016!

By Elliot Funt

Safe Place for International Investors

There is no doubt that for at least the short-term the Vancouver (and Canadian) housing market will be seen as a safe place for international investors in comparison to the United States housing. For sellers, this comes at an excellent time as it off-puts the impacts of the 15% foreign buyers tax in Vancouver.

China

In particular, Trump's has said that he plans to have a firm stance against China. This strong position will undoubtedly mean Canada is, in comparison, a safe-haven for Chinese money. In Trump's trade policies, points #5, #6, and #7 aim at restricting China's trade influence in America.

United States

Calls are already coming into real estate agents in Vancouver from Canadian citizens currently living in the US and from some US citizens. The running joke made by Democrats wanting to move to Canada may now have a level of truth that, in combination with other foreign money, is enough to increase Canadian housing prices.

Mexico

The number of refugee claims from Mexico is expected to increase drastically according to a CBC article published Nov 10th. As of December 1st, Canada is dropping the tourist visa requirement for Mexican visitors. Trudeau announced this change in visa requirements on June 28th, well before the election upset. It appears that any restriction on Mexican tourist visas closely associates with lower refugee claims from Mexico.

Sources:

https://www.donaldjtrump.com/policies/trade

http://www.cbc.ca/news/politics/canada-mexico-visa-requirement-trump-1.3845957

Disclaimer:

The information provided here is meant to be a recap of current news and does not constitute advice about the market one way or another. It is advised you contact your REALTOR® (such as me) and other sources before making any major financial decision

By Elliot Funt

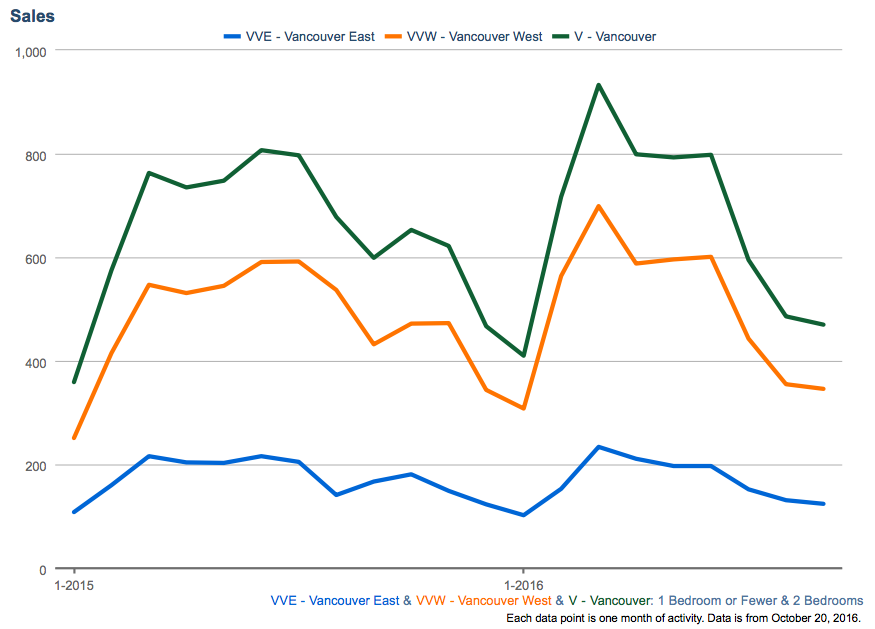

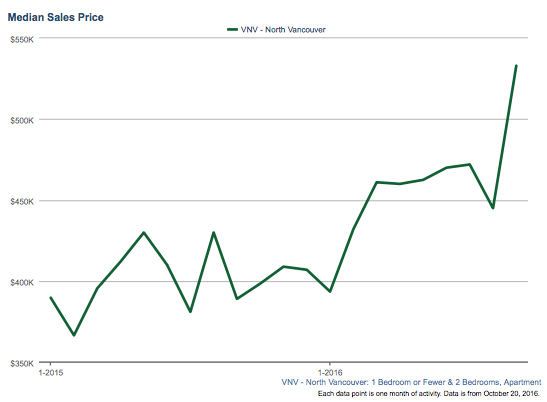

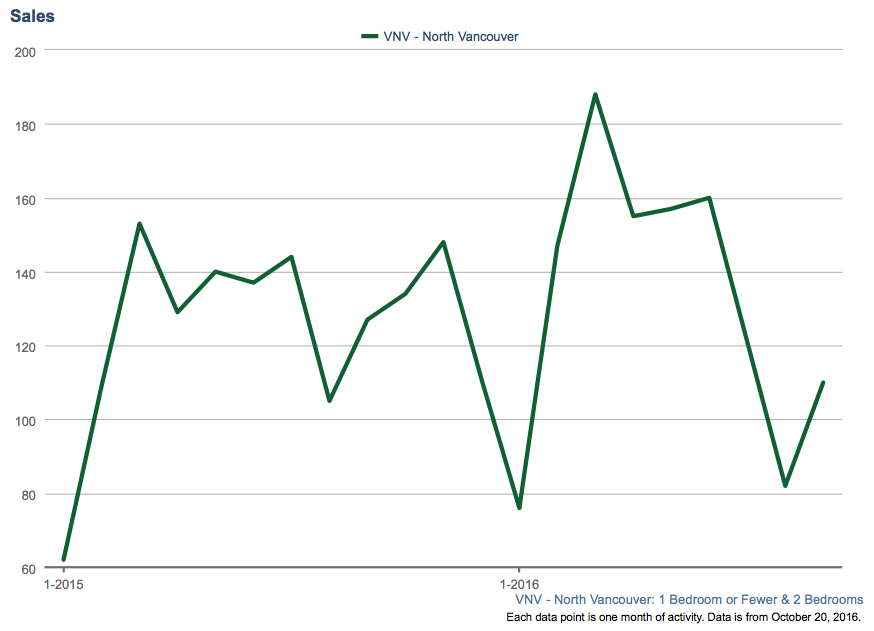

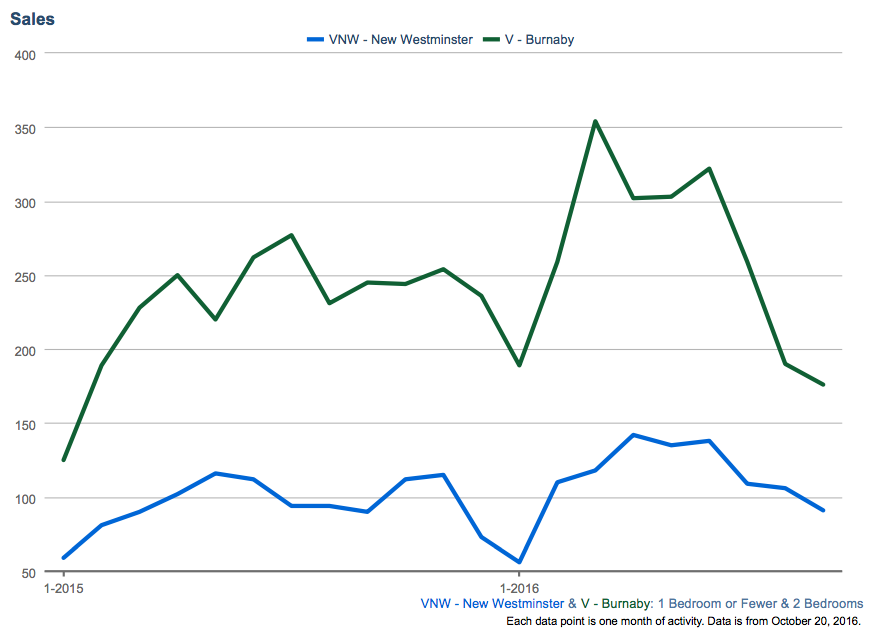

My post today specifically analyzes sales and sales prices for studios, 1-bedroom, and 2-bedroom condos in Vancouver and it’s surrounding areas. There has been much speculation about how this portion of the market will react due to the 15% foreign-buyers-tax and increased restrictions on the mortgage market. The market for a studio, 1-bdrm, and 2-bdrm condos is also an important market as many first-time buyers will be looking in this market.

For the analysis of the charts, I have included all price ranges. If I were to exclude the upper price range for these condos, I’d overlook properties that were once within a range and have increased as to be out of any price range in question. West Vancouver is excluded due to a lack of data in this segment of the market.

Sales Down, Yet Prices Up In Many Areas

Sales are down in all areas since earlier this year. While sales are down in all areas, prices continue to rise in North Vancouver, Burnaby, and New Westminster. All of these markets appear to be relatively safe choices with localized pockets of economic growth. Burnaby and New Westminster have seen steady price increases stabilized in part due to the opening of new Evergreen Skytrain line opening up in that area. North Vancouver continues to grow and be stable in this market, with heavy levels of ongoing development in North Vancouver. North Vancouver also has the added stability in the studio, 1-bdrm, and the 2-bdrm market as many of the buyers in this market are North Shore raised and specifically want to purchase on the North Shore.

Vancouver Sales Prices Down

Vancouver itself has seen a slight decline in sales prices since earlier this year, though nothing too substantial. Vancouver itself will inevitably go up over the long-run, though clearly many buyers are waiting to see what happens in the short-term market. The tradeoff for many buyers in the condo segment of the market will come down to how much rent they will pay during the time of this slight market instability. I am looking for a new place in the West End and wouldn’t hesitate on the right place at the right price. I feel that there are many good deals to be had while other buyers are waiting on their decision to see what the market does.

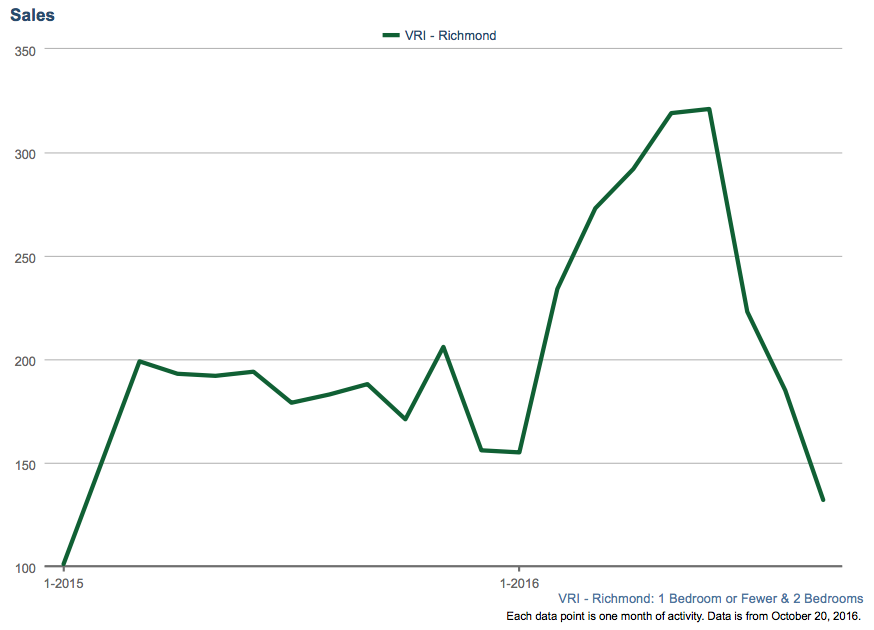

Richmond Instability

Richmond has taken a particularly steep decline in prices in the last three months, though is still up overall from a year ago. I would be particularly cautious of this portion of the market for the next few months and certainly, seek expert advice if you’re on the hunt. As with the Vancouver market, there are good deals to be hand, though the risk/reward is amplified in the Richmond market. Due to the massive foreign investment in the Richmond area, it is no surprise that Richmond has been hit quite hard by the foreign-buyers-tax.

Sources:

Disclaimer:

The information provided here is meant to be a recap of current news and does not constitute advice about the market one way or another. It is advised you contact your REALTOR® (such as me) and other sources before making any major financial decision.

By Elliot Funt

Mortgage Rule Changes From February

Last Last December the federal government announced new down payment measures to “Maintain a Healthy, Competitive and Stable Housing Market”. These rules were implemented in mid-February and attracted headlines at the time.

The primary change moved the threshold of 5% down payment on properties under $1,000,000, to 5% down payment for under $500,000, with 10% down payment from $500,000 to 1,000,000.

Over $1,000,000 the rules in place remain unchanged. As it stands, a 20% down payment is needed on properties over $1,000,000. In addition, you will need your mortgage insured if your down payment is less than 20% of the property value.

Stress Test Requirement Expanded Oct 17th

The stress test was already in effect for high-ratio mortgages (small down-payment or term less than 5-years). As of today, Oct 17th, 2016, the stress test requirements expand to encompass all buyers with insured mortgages.

This means that buyers will be tested against the federal 5-year conventional (fixed) mortgage rate (currently 4.64%), rather than a 5-year fixed rate offered by some lenders (as low as 2.14% in some cases).

The stress test does not mean that all borrowers now need to pay a rate of 4.64%, but rather that they need to qualify for their loan using this as their rate. The idea is that if the mortgage rate goes up on their loan (say from 2.7%), they will still be able to make payments toward their loan without financial difficulty.

Portfolio Insurance

There is a good chance you may have never heard of portfolio insurance because it primarily impacts lenders rather than buyers. This is a type of insurance from the CMHC (Canadian Mortgage and Housing Corporation) - a crown corporation. Portfolio insurance effectively gives a bulk discount on mortgages with down payments over 20% of the property value. Along with the other requirements announced, lenders looking to purchase Portfolio Insurance will now face stricter requirements.

My Opinion

I view these new requirements positively on the whole. I feel the “stress test” will make the mortgage market stronger and will lower the chance of a mortgage backed housing crash similar to the 2007/2008 housing crisis in the United States.

Stricter requirements on portfolio insurance will not have any immediate effect on mortgages, but will mean a small increase on rates in years to come as the stricter requirements translates into a higher cost of business for lenders.

Sources:

http://www.fin.gc.ca/n15/15-088-eng.asp

http://www.fin.gc.ca/n16/16-117-eng.asp

http://www.ratehub.ca/mortgages

http://www.bankofcanada.ca/rates/daily-digest/

https://www.cmhc-schl.gc.ca/en/corp/nero/jufa/jufa_033.cfm

Disclaimer:

The information provided here is meant to be a recap of current news and does not constitute advice about the market one way or another. It is advised you contact your REALTOR® (such as me) and other sources before making any major financial decision.

By Elliot Funt

There have been mixed reports this week on the future market. Optimism in the news from local sources and experts has been matched with pessimism due to a report from published by UBS.

The most widely circulated Vancouver news article in the news this week was the forecast from UBS. The UBS forecast was covered by nearly all top Canadian news sources (The Financial Post, CBC, Globe and Mail, Vancouver Sun - to name a few). The Financial Post reported “UBS Global Real Estate Bubble Index 2016 listed 18 cities around the globe and their risk and found Vancouver with the greatest probability of a bubble.” Articles from the other sources on this subject all follow a similar tune.

While the UBS report is certainly a worrying report concerning the Vancouver market, UBS stated that the main factor leading to their conclusion is the incredibly low interest rates available to consumers. Low interest rates are hardly a new thing for the Canadian marketplace.

With the exception of the articles on the major UBS forecast, there have been several positive articles on the local housing market. Two of such articles were published in REW (Real Estate Weekly). REW reported that during a panel held by the UDI (Urban Development Institute) on September 16th, Helmut Pastrick, the chief economist at Central 1 Credit Union, said that prices will be “higher next year than they are today.”

Among other panelists, Pastrick was joined by Tsur Sommerville, associate professor at UBC’s Centre for Urban Economics and Real Estate. Along a similar tangent to Pastrick, Sommerville noted that “In other markets where a foreign buyer tax was introduced, such as Hong Kong and Singapore, prices continued to rise.” Sommerville’s point is certainly an interesting one - so I dove a little deeper into what he is quoted with saying. Hong Kong currently charges 15% tax on foreign buyers and Singapore currently charges 18% tax. Sommerville is certainly correct in his remark that Hong Kong’s real estate market has been relatively unaffected by their 15% tax. I found several articles over the last few years making similar notes of their foreign-buyer tax. Vancity Buzz had noted in November of 2015 that the taxes were “not enough to deter foreign investors... Even after the taxes were introduced, housing prices continued to rise.” Sommerville also made note of the strong millennial influence in the Vancouver marketplace, adding that this group is going to continue to buy and keep the market steady.

In terms of current Hong Kong market trends, it appears as Hong Kong has finally experienced some slowing of the market, but it appears to be unrelated to their foreign-buyer tax. Q4 of 2015 and Q1 of 2016 showed the most major slows for the Hong Kong market since the tax was introduced way back in 2012. Other factors seem to be affecting the Hong Kong market in particular. Global Property Guide reported that there was a “sharp decline in the flow of money following the intensification of government crackdowns on the wealthy in Mainland China.” There have also been a handful of other factors affecting the Hong Kong real estate and their economy.

In a similar story also published by REW, “Tina Mak, a Vancouver real estate agent and founder of the Vancouver chapter of the Asian Real Estate Association of America, Mak urged buyers to remember the words of legendary investor Warren Buffett: ‘Be fearful when others are greedy and greedy when others are fearful.’” Based on the opinions and recent articles in the news, I feel that Buffett’s words ring true and is sound advice for those looking in the Vancouver market - especially to local buyers looking to get into their first home or condo. If the market does go down in the next few months, the market will quickly recover and it is extremely likely that the cost of housing will only be higher at this time next year.

Sources:

http://www.vancitybuzz.com/2015/11/vancouver-real-estate-foreign-investment-restrictions/

http://www.rew.ca/news/vancouver-home-prices-will-be-higher-this-time-next-year-leading-economist-1.2346757

http://business.financialpost.com/personal-finance/mortgages-real-estate/vancouver-tops-international-list-of-bubble-cities-on-global-real-estate-risk-index

http://www.globalpropertyguide.com/Asia/Hong-Kong#http://www.colliers.com/-/media/files/marketresearch/apac/hongkong/hk-research/hk-residential-q1-2016.pdf

http://www.tradingeconomics.com/hong-kong/housing-index

Disclaimer:

The information provided here is meant to be a recap of current news and does not constitute advice about the market one way or another. It is advised you contact your REALTOR® and other sources before making any major financial decisions.