It's time to consider the West End!

Viewing entries in

West Vancouver

March Stats Report from the Real Estate Board of Greater Vancouver

February Stats Report from the Real Estate Board of Greater Vancouver

January Stats Report from the Real Estate Board of Greater Vancouver

December Stats Report from the Real Estate Board of Greater Vancouver

November Stats Report from the Real Estate Board of Greater Vancouver

Luxury Condo Report for December 3rd, 2017.

Metro Vancouver July Stats Report

My crazy viral video, a little about my ties to Howe Sound, and a little about The Howe Sound Declaration / stopping Woodfibre LNG!

The 5 coolest properties I viewed in 2016!

By Elliot Funt

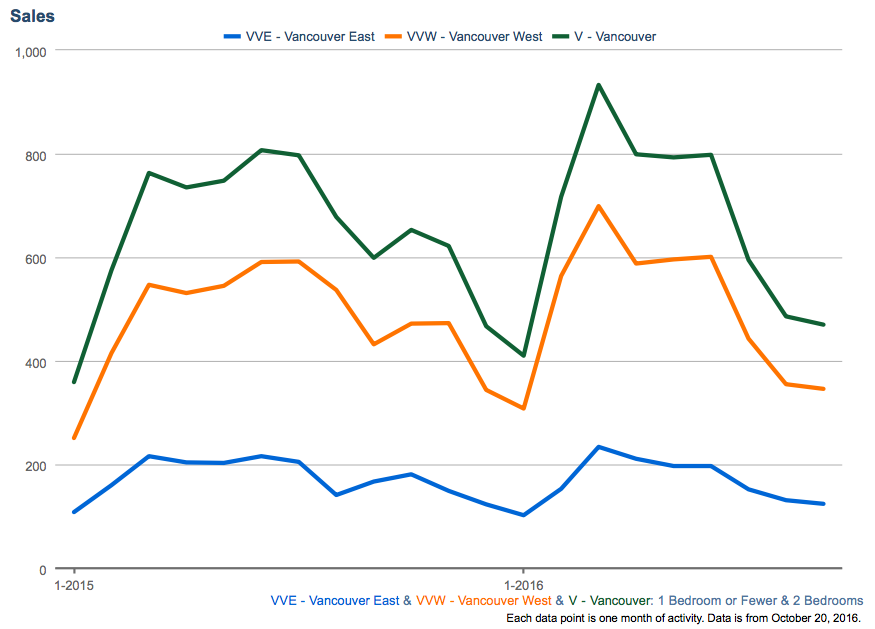

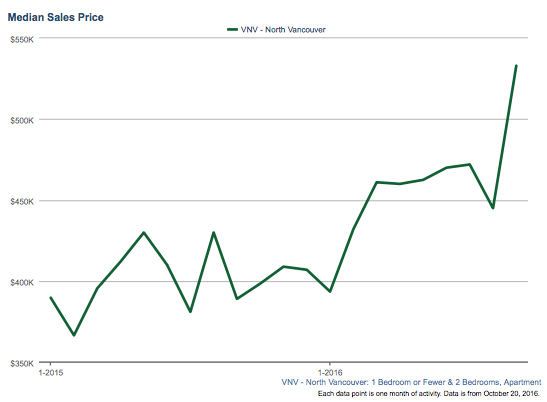

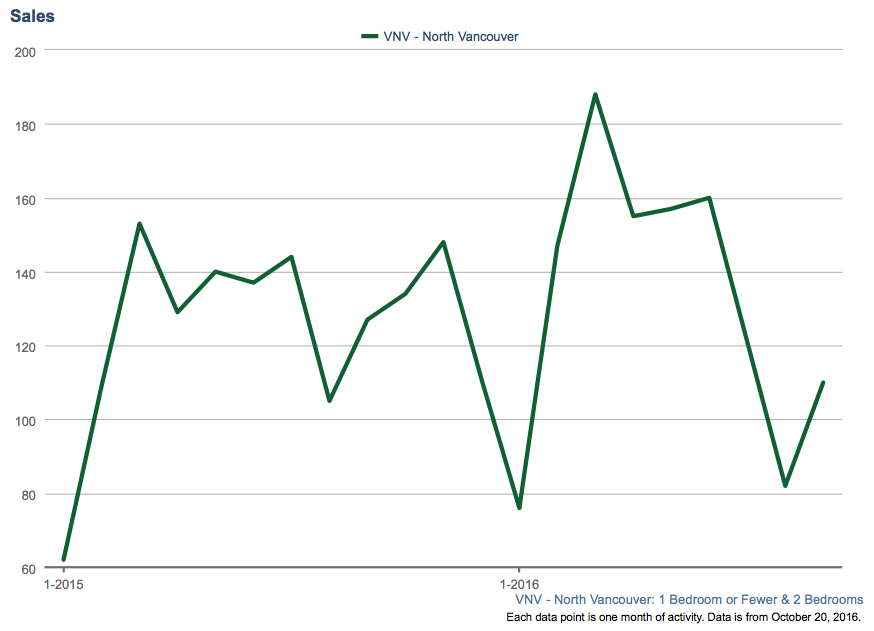

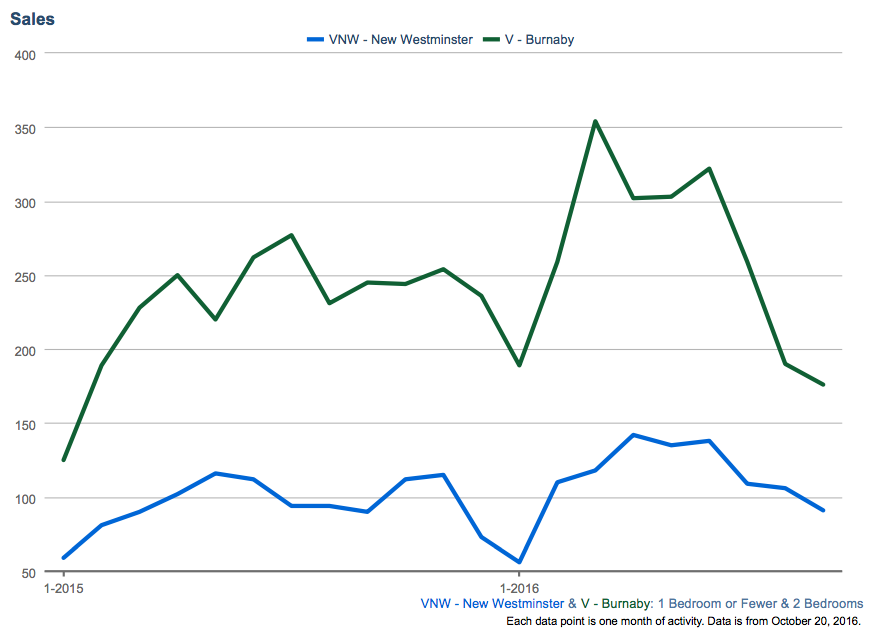

My post today specifically analyzes sales and sales prices for studios, 1-bedroom, and 2-bedroom condos in Vancouver and it’s surrounding areas. There has been much speculation about how this portion of the market will react due to the 15% foreign-buyers-tax and increased restrictions on the mortgage market. The market for a studio, 1-bdrm, and 2-bdrm condos is also an important market as many first-time buyers will be looking in this market.

For the analysis of the charts, I have included all price ranges. If I were to exclude the upper price range for these condos, I’d overlook properties that were once within a range and have increased as to be out of any price range in question. West Vancouver is excluded due to a lack of data in this segment of the market.

Sales Down, Yet Prices Up In Many Areas

Sales are down in all areas since earlier this year. While sales are down in all areas, prices continue to rise in North Vancouver, Burnaby, and New Westminster. All of these markets appear to be relatively safe choices with localized pockets of economic growth. Burnaby and New Westminster have seen steady price increases stabilized in part due to the opening of new Evergreen Skytrain line opening up in that area. North Vancouver continues to grow and be stable in this market, with heavy levels of ongoing development in North Vancouver. North Vancouver also has the added stability in the studio, 1-bdrm, and the 2-bdrm market as many of the buyers in this market are North Shore raised and specifically want to purchase on the North Shore.

Vancouver Sales Prices Down

Vancouver itself has seen a slight decline in sales prices since earlier this year, though nothing too substantial. Vancouver itself will inevitably go up over the long-run, though clearly many buyers are waiting to see what happens in the short-term market. The tradeoff for many buyers in the condo segment of the market will come down to how much rent they will pay during the time of this slight market instability. I am looking for a new place in the West End and wouldn’t hesitate on the right place at the right price. I feel that there are many good deals to be had while other buyers are waiting on their decision to see what the market does.

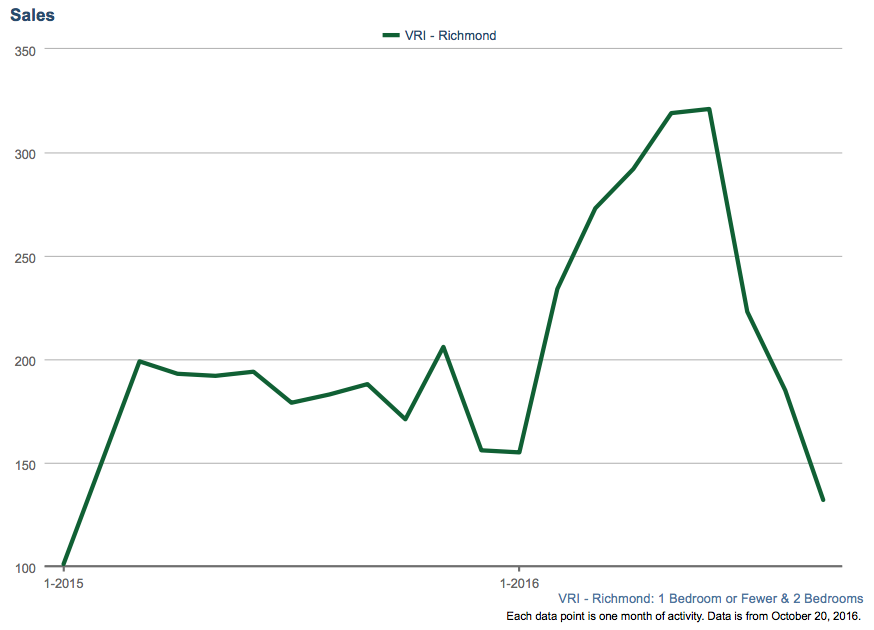

Richmond Instability

Richmond has taken a particularly steep decline in prices in the last three months, though is still up overall from a year ago. I would be particularly cautious of this portion of the market for the next few months and certainly, seek expert advice if you’re on the hunt. As with the Vancouver market, there are good deals to be hand, though the risk/reward is amplified in the Richmond market. Due to the massive foreign investment in the Richmond area, it is no surprise that Richmond has been hit quite hard by the foreign-buyers-tax.

Sources:

Disclaimer:

The information provided here is meant to be a recap of current news and does not constitute advice about the market one way or another. It is advised you contact your REALTOR® (such as me) and other sources before making any major financial decision.

By Elliot Funt

Mortgage Rule Changes From February

Last Last December the federal government announced new down payment measures to “Maintain a Healthy, Competitive and Stable Housing Market”. These rules were implemented in mid-February and attracted headlines at the time.

The primary change moved the threshold of 5% down payment on properties under $1,000,000, to 5% down payment for under $500,000, with 10% down payment from $500,000 to 1,000,000.

Over $1,000,000 the rules in place remain unchanged. As it stands, a 20% down payment is needed on properties over $1,000,000. In addition, you will need your mortgage insured if your down payment is less than 20% of the property value.

Stress Test Requirement Expanded Oct 17th

The stress test was already in effect for high-ratio mortgages (small down-payment or term less than 5-years). As of today, Oct 17th, 2016, the stress test requirements expand to encompass all buyers with insured mortgages.

This means that buyers will be tested against the federal 5-year conventional (fixed) mortgage rate (currently 4.64%), rather than a 5-year fixed rate offered by some lenders (as low as 2.14% in some cases).

The stress test does not mean that all borrowers now need to pay a rate of 4.64%, but rather that they need to qualify for their loan using this as their rate. The idea is that if the mortgage rate goes up on their loan (say from 2.7%), they will still be able to make payments toward their loan without financial difficulty.

Portfolio Insurance

There is a good chance you may have never heard of portfolio insurance because it primarily impacts lenders rather than buyers. This is a type of insurance from the CMHC (Canadian Mortgage and Housing Corporation) - a crown corporation. Portfolio insurance effectively gives a bulk discount on mortgages with down payments over 20% of the property value. Along with the other requirements announced, lenders looking to purchase Portfolio Insurance will now face stricter requirements.

My Opinion

I view these new requirements positively on the whole. I feel the “stress test” will make the mortgage market stronger and will lower the chance of a mortgage backed housing crash similar to the 2007/2008 housing crisis in the United States.

Stricter requirements on portfolio insurance will not have any immediate effect on mortgages, but will mean a small increase on rates in years to come as the stricter requirements translates into a higher cost of business for lenders.

Sources:

http://www.fin.gc.ca/n15/15-088-eng.asp

http://www.fin.gc.ca/n16/16-117-eng.asp

http://www.ratehub.ca/mortgages

http://www.bankofcanada.ca/rates/daily-digest/

https://www.cmhc-schl.gc.ca/en/corp/nero/jufa/jufa_033.cfm

Disclaimer:

The information provided here is meant to be a recap of current news and does not constitute advice about the market one way or another. It is advised you contact your REALTOR® (such as me) and other sources before making any major financial decision.