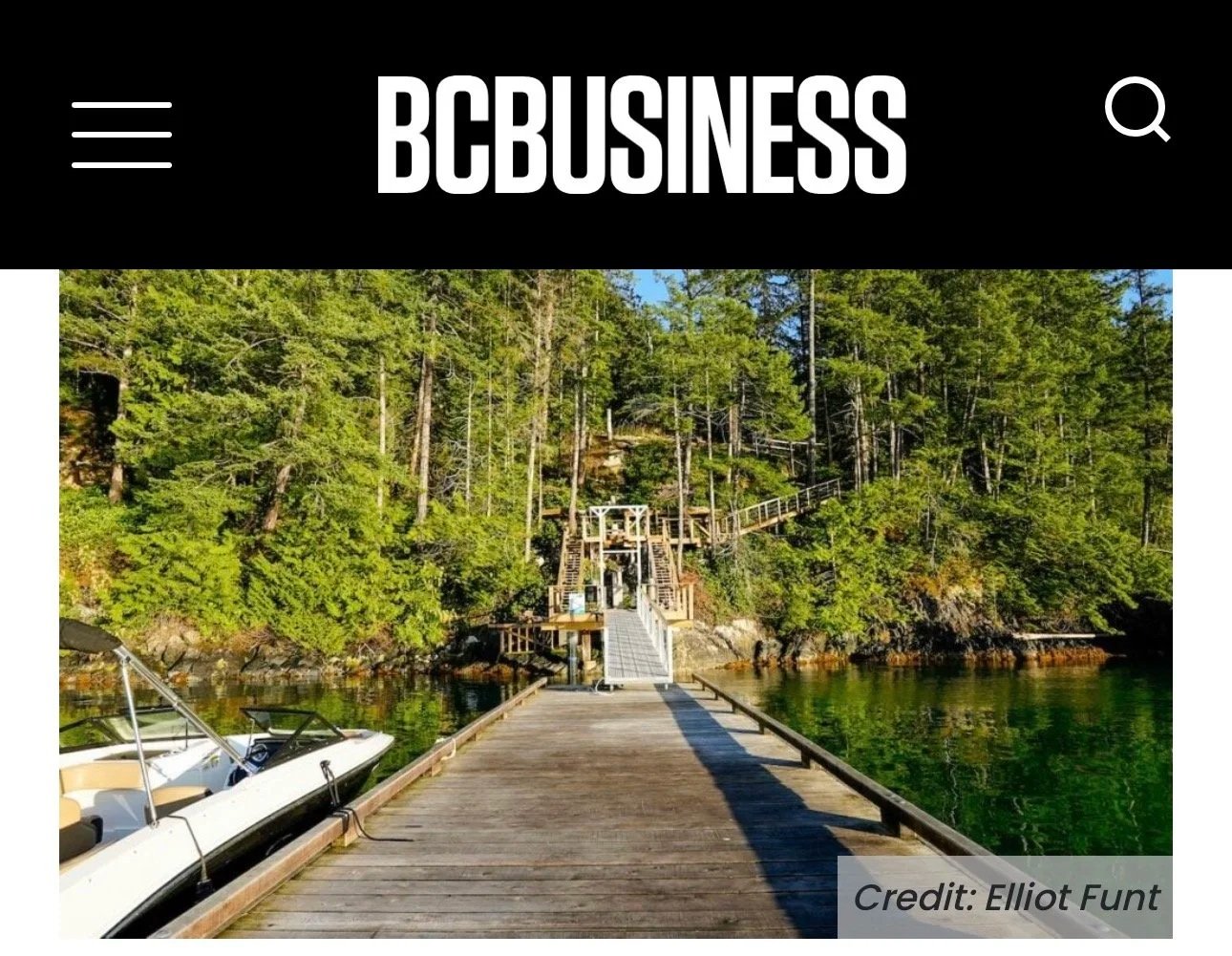

Written by: Elliot Funt, Real Estate Advisor, Engel & Völkers Vancouver

Pricing a British Properties View Home (West Vancouver)

The photo I used with this post is a bit blurry. It was taken more than 20 years ago, before I had anything resembling a decent camera. But it’s the view from my childhood house in the British Properties, so I kept it.

And that’s also why I’m sympathetic when sellers tell me the view is “the whole point.” In the British Properties, it often is.

Which brings me to pricing.

“Let’s just test the market” is one of the most expensive sentences in the British Properties.

I get why it comes up. If you’ve got a real view up there, it doesn’t feel like you’re selling the same thing as the next house down the street. It feels unique, and it feels like the right buyer will pay for it.

But here’s what I’ve watched happen more times than I can count: you list high “just to see,” you get a bunch of showings, everyone loves the view, and then… nothing. No offer. Or you get a low one that annoys you. Then you start trimming the price in small cuts, and the listing slowly turns into a project.

Right now, the British Properties is taking way longer than the regional average to sell. Part of that is just the price point. But part of it is also pricing that isn’t realistic. I’m not going to hardcode numbers here — I’m adding a screenshot from the GVREALTORS Stats Centre, and that’ll show the current days-on-market picture much more cleanly than quoting a number that’s already outdated next month. Also here’s the current link to the same stat if you’re reading this in the future and want to see if it has changed: https://statscentre.gvrealtors.ca/infoserv/s-v1/n9VV-NPJ

The other thing that doesn’t show up in a simple “days on market” stat is the re-list effect. A lot of British Properties listings aren’t truly “new.” They’re re-lists — sometimes the second or third try, sometimes the tenth — spread over years. So even if the public counter resets, the market memory doesn’t. Buyers (and agents) remember the house, the old price, the old photos, and the fact that it didn’t move. That baggage is real.

Views themselves also aren’t a yes/no. They’re ranked. People pay differently for a view that’s wide and open from the living room and kitchen versus a view you only enjoy from one bedroom. They pay differently for a view that feels private versus a view where you feel exposed the second it’s dark outside. They pay differently for a view that feels “safe” versus one where you can look at the lot in front and tell something is going there eventually. Two “view homes” can be worlds apart, even if both technically have water showing.

Here’s the practical part. If you want to sell without a long, slow sit, you want to be the home that looks like the obvious choice when buyers compare options. Not the one they say, “Beautiful… but we’ll wait for it to come down.” Because most buyers won’t negotiate with an overpriced listing. They just move on and check back later.

And don’t underestimate presentation at this price point. If you’re asking a premium number, the house has to feel like it within the first minute of walking in. Photos matter. Showing availability matters. If the photos don’t actually show the view properly, or the house shows like someone is halfway packed, buyers don’t think “maybe it’s better in person.” They think, “They want top dollar and they didn’t bother.”

If you miss the price, the fix also has to happen early. Tiny reductions after a month don’t reset anything. They just teach buyers to wait. If you’re going to adjust, do it while you still feel like the new listing people are curious about.

If you’re tempted to “test,” ask yourself a blunt question: do you want a clean sale while your listing is still fresh, or do you want months of showings, second-guessing, and price cuts for the chance that one perfect buyer appears?

If you want, send me the address (or a couple listings you think you’re competing with). I’ll tell you what I’d actually use as pricing anchors for a British Properties view home — and what I think happens if you start too high.

Reach out to me at Elliot@Funt.ca or (778) 991 - 3868 (text/phone).

Elliot Funt - Real Estate Advisor with Engel & Völkers Vancouver

Investment Information on Airbnbs and Short Term Rentals in Downtown Vancouver